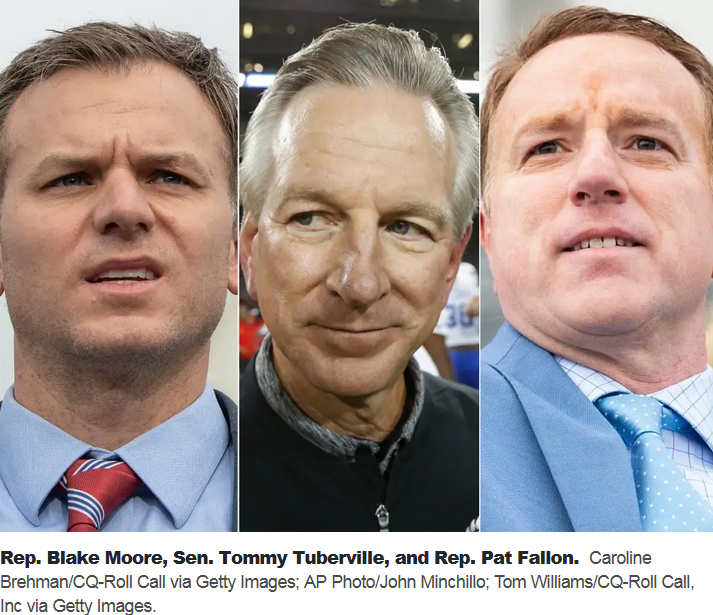

Sen. Tommy Tuberville, and Reps. Pat Fallon and Blake Moore, are targeted by the complaints.

The Campaign Legal Center says the members broke transparency rules.

The complaints are in part based on reporting by Insider.

By Dave Levinthal

A watchdog organization is accusing three Republicans serving in Congress of violating a federal transparency law by failing to properly disclose millions of dollars worth of stock trades.

The separate complaints by the nonpartisan Campaign Legal Center were filed Thursday afternoon with the Office of Congressional Ethics and US Senate Select Committee on Ethics. They allege Sen. Tommy Tuberville of Alabama, as well as Reps. Pat Fallon of Texas and Blake Moore of Utah, illegally delayed by weeks or months their numerous stock trades.

"When members of Congress trade individual stocks and fail to disclose those trades, they break the law and diminish the public's trust in government," the three complaints each state.

"The recent prevalence of STOCK Act violations in the House shows that merely the threat of a fine is not deterring members of Congress from breaking the law; real accountability is necessary."

The Campaign Legal Center's complaints are based in part on reporting by Insider, which in June and July revealed that Tuberville, Fallon, and Moore had violated the STOCK Act.

The law, which Congress passed in 2012, is designed to defend against corruption and conflicts of interest, particularly for lawmakers who have personal financial interests in companies that vie for lucrative government contracts and spend millions of dollars each year lobbying the federal government. Among its provisions, the STOCK Act requires members of Congress to formally and publicly disclose any individual stock trade they make within 45 days of making it.

Members of Congress who violate the STOCK Act often must only pay a $200 late filing fine, regardless of the overall value of the trades they were tardy in disclosing. Congressional ethics committees may refer "knowing and willful" violations of the STOCK Act to the Department of Justice for criminal investigation, although this is rare.

Insider has reported that a growing number of federal lawmakers — Republicans and Democrats — have this year violated the law's disclosure mandates.

"This is all triggered by a clear trend of members of Congress defeating the purpose of the STOCK Act," said Kedric Payne, the Campaign Legal Center's general counsel and senior director for ethics.

"My hope is that the members will comply with the law that they created. But if complying with that law is too difficult for them, that supports the idea that's been suggested that there should be restrictions on how they trade stocks."

Reached Thursday afternoon, Tuberville spokeswoman Ryann DuRant said that "Sen. Tuberville has filed all required paperwork with the Ethics Committee. He was assessed a late filing penalty, and it has been paid."

In a statement to Insider on Thursday evening, Moore's congressional office said that when the congressman "was made aware of the deadline oversight, he immediately worked in consultation with the Ethics Committee to meet the requirements of the statutory remedy for late filings, and he has paid a late filing fee in full. Now that Congressman Moore has fully established a financial compliance process with his firm and the Ethics Committee, he will continue to ensure all future filing deadlines are met in accordance with Ethics rules."

Representatives for Fallon did not respond to a request for comment.

Previously, spokespeople for each lawmaker told Insider that their respective member of Congress will work to comply with the law in the future and that they do not personally make their own stock trades. Instead, they employ financial advisors to buy and sell stock on their behalf.

Payne said that each member of Congress is personally responsible for following the law.

Earlier this year, the Campaign Legal Center filed an ethics complaint against Rep. Tom Malinowski, a New Jersey Democrat, who Insider revealed has failed to disclose dozens of stock trades during 2020.

The Foundation of Accountability and Civic Trust, a conservative watchdog organization, also filed a complaint against Malinowski and also filed an unrelated STOCK Act ethics complaint against Rep. Sean Patrick Maloney, a Democrat from New York.

Read more:

Republican Rep. Blake Moore violated federal transparency law by failing to properly disclose stock transactions worth up to $1.1 million

Republican Rep. Pat Fallon failed to properly disclose more than 90 stock transactions worth as much as $17.53 million in apparent violation of federal law

----------------------------------------------------------